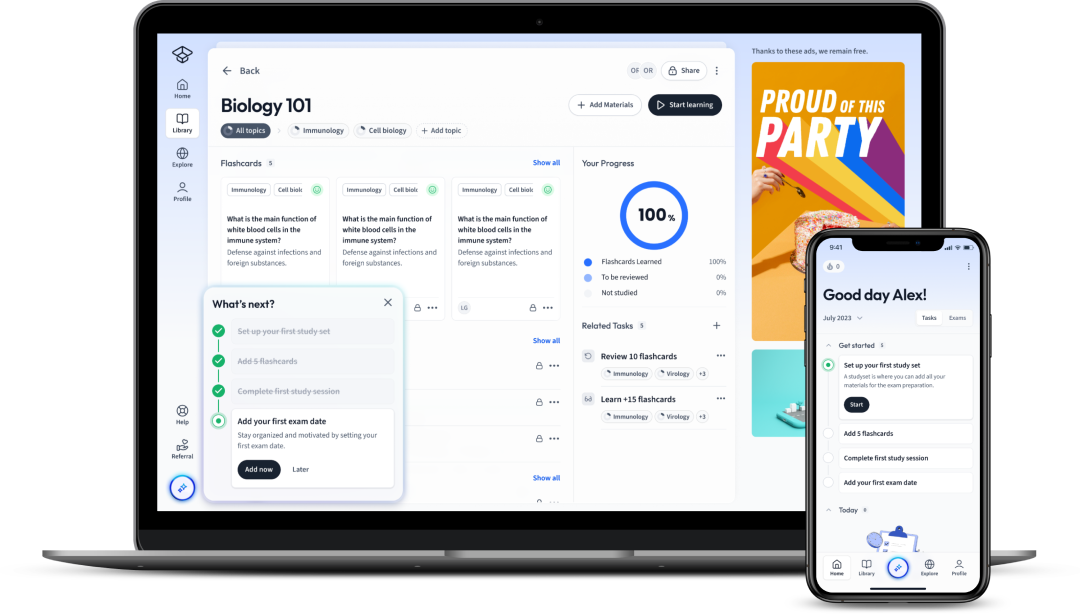

StudySmarter - The all-in-one study app.

4.8 • +11k Ratings

More than 3 Million Downloads

Free

Americas

Europe

Dive into the intricacies of Earnings Per Share, a pivotal concept in business studies, through an engaging and enlightening exploration. You'll gain a comprehensive understanding of its definition, and how its influence extends to corporate finance. Delve deeper into its mathematical underpinnings, example calculations, and the meaning behind negative earnings. Finally, equip yourself with practical analytical skills, learning to interpret Earnings Per Share results and navigate situations with negative figures. Knowledge awaits, offering you the potential to make informed investment decisions and comprehend business financial health better.

Explore our app and discover over 50 million learning materials for free.

Lerne mit deinen Freunden und bleibe auf dem richtigen Kurs mit deinen persönlichen Lernstatistiken

Jetzt kostenlos anmeldenDive into the intricacies of Earnings Per Share, a pivotal concept in business studies, through an engaging and enlightening exploration. You'll gain a comprehensive understanding of its definition, and how its influence extends to corporate finance. Delve deeper into its mathematical underpinnings, example calculations, and the meaning behind negative earnings. Finally, equip yourself with practical analytical skills, learning to interpret Earnings Per Share results and navigate situations with negative figures. Knowledge awaits, offering you the potential to make informed investment decisions and comprehend business financial health better.

You might have come across the term 'Earnings Per Share' or EPS if you've been delving into the world of investments or corporate finance. But what does it actually mean and why is it so significant in business studies? Let's dive into the fascinating world of EPS and unravel these questions.

The term Earnings per Share (EPS) represents the portion of a company's profit that is allocated to each outstanding share of common stock. It serves as an indicator of a company's profitability, interpreted broadly as the "earnings" or profit made per each share held.

So, in simple terms, EPS is the portion of a company's profit attributed to every individual share of its common stock. It's calculated using the following formula:

EPS is considered one of the most important financial ratios and is widely used by investors while making investment decisions. An increasing EPS over time can be a good sign that the company’s profit is on the rise.

EPS plays a significant role in corporate finance. It's one of the numbers that analysts look at when deciding whether to invest in a company's stock. Companies strive to keep their EPS as high as possible as it directly impacts investors' perspectives.

For example, two companies A and B have the same amount of net income. However, company A has fewer outstanding shares than company B. Consequently, company A will have a higher EPS than company B, thus appearing more attractive to investors.

Yes, a company's Earnings per Share can increase. This could be due to an increase in net income, reduction in outstanding shares, or both. Here's how it could happen:

An increase in Earnings per Share is often a good sign for investors. It could signal that the company is becoming more profitable, and investors may expect higher dividends and capital appreciation. However, it's crucial for investors to consider other financial ratios and a company's overall fiscal health, as the EPS alone may not tell the entire story.

For instance, a company might finance its growth through debt. While it might lead to an increase in EPS, a high level of debt might expose the company to financial risk. Therefore, it's essential for investors to perform comprehensive financial analysis.

Understanding the intricate calculations that allow us to arrive at the Earnings Per Share (EPS) is a pivotal part of comprehending company financials and the implications these can have for investors and shareholders alike. Let's delve into the fascinating details of the mathematics so you can firmly grasp the concept.

The formula to calculate the Earnings Per Share is straightforward but carries immense value for investors looking to understand a company's profitability relative to the shares they own. The formula is as follows:

\[ \text{{EPS}} = \frac{{\text{{Net Income}} - \text{{Dividends on Preferred Stock}}}}{{\text{{Number of Outstanding Shares}}}} \] In the formula, each component serves a specific purpose:To process the EPS formula, you only need the numbers presented on a company's financial statements. Let's start with the net income. You'll find it on the company's income statement, usually the bottom line, as it’s calculated after all operating costs, taxes, and other expenses, are deducted from the company's total revenue. The dividends on preferred stock also appear on the annual financial statement. Since preferred dividends are earnings not available to common stock shareholders, it's essential to subtract them to calculate the correct EPS. The average number of common shares outstanding over an accounting period, typically a year, is found in the shareholder equity section in the balance sheet. After having gathered these numbers, it's a straightforward task to input them into the EPS formula.

Let's consider an example of company XYZ to better grasp the Earnings Per Share calculation:

Suppose company XYZ has a net income of £800,000. It has distributed £100,000 as dividends to preferred stockholders. Furthermore, XYZ company has 350,000 outstanding shares of common stock.

The EPS calculation would consequently be:

\[ \text{{EPS}} = \frac{{\text{{Net Income}} - \text{{Dividends on Preferred Stock}}}}{{\text{{Number of Outstanding Shares}}}} = \frac{{800,000 - 100,000}}{{350,000}} \]With some simple math:

\[ \text{{EPS}} = 2 \]So, the EPS for company XYZ is £2. Consequently, XYZ company has earned £2 per outstanding share of common stock.

A negative Earnings Per Share value, often seen in parentheses (eg. -£1.50 EPS), signifies that the company is incurring losses instead of making profits. This could be due to high costs, economic recession, a downturn in the industry, or poor management. Similarly to profitable scenarios, the higher the absolute value of the negative EPS, the higher the loss per share of common stock. For instance, if a company reports an EPS of -£0.50, it means it has lost 50 pence for every outstanding share over the specific period. A negative EPS isn't an uncommon occurrence, especially for start-ups and companies in growth or transition phases. However, sustained negative EPS over multiple years could be a warning sign for investors, as it could indicate systemic issues within the company. This comprehensive dive into the mathematics behind Earnings Per Share provides a clearer understanding of how EPS is calculated and the insights it can bring. Armed with this knowledge, you're better equipped to interpret EPS as part of your broader analysis when making business decisions.

Analysis of Earnings Per Share (EPS) forms an integral part of financial analysis for business analysts, investors, and even management. This mainstay of financial reporting provides great insights into a company's profitability and financial performance. Let’s now delve into more profound aspects of EPS analysis and discover what it reveals.

When performing an analysis of Earnings Per Share, you're primarily focusing on trends in the EPS over time and comparing the EPS with other companies in the same sector. EPS Ratio Analysis or EPS Analysis involves the calculation and assessment of key parameters to provide a comprehensive view of the company’s economic health and stability.

Here are a few important concepts to keep in mind while carrying out an EPS analysis:

Earnings Per Share is a potent tool to gauge a company's profitability on a per-share basis. But the number alone doesn’t tell the complete story. Interpretation of the EPS figure, context, and trends are equally important. A high EPS can mean that a company is profitable and, potentially, a good investment. However, you should take other factors into account such as the company's price-to-earnings (P/E) ratio, debt levels, future prospects, and overall financial health.

Price-to-earnings (P/E) ratio is the ratio of a company's share price to its earnings per share. It is a widely used stock valuation measure. A lower P/E ratio might indicate that the stock is undervalued, while a higher P/E ratio might suggest overvaluation. However, the appropriate P/E ratio can vary significantly between different industries.

While Earnings Per Share is a significant measurement of a company's profitability, always be sure to use it alongside other financial ratios for a comprehensive inspection.

Understanding the practical implications of Earnings Per Share interpretation is vital for making informed investment or strategic decisions. A high EPS typically indicates a potentially lucrative company from an investor's perspective because it signifies that a business is capable of generating sizable profits. That’s why companies strive for a high EPS, trying to make their stocks more appealing. On the other hand, a low EPS could signal weak profitability or difficulties ahead.

Suppose a company has consistently increased its EPS over the past five years. It's indicative of growing profitability and may suggest that the company is a stable entity and a good investment candidate. However, investors should also consider the Economic Environment, Industry Trends, Company's Future Plans, and Other Financial Ratios to make a holistic decision.

A negative Earnings Per Share can be daunting and raise several red flags. It indicates that the company is not earning profits, rather, it's generating losses. When encountered with a negative EPS, it's crucial to comprehend the underlying reasons. Is it due to increased operating costs, an overall economic downturn, or lack in management efficiency? Is it a one-time situation or a chronic issue?

Keeping its root cause in mind, investors, analysts, and management should devise a strategy accordingly. A one-time negative EPS may not be a severe issue, especially in sectors where companies face cyclical profitability or where firms are still in their start-up phase. Here, the emphasis should be on the management's strategy to navigate the downturn and increase profits in the future.

However, a persistent or chronic negative EPS is a far more ominous sign. It could signify a fundamental issue with the company's business model or management. In such situations, serious considerations about the continuing viability of the enterprise are needed.

Remember, just as with positive EPS, negative EPS should also be compared with other businesses within the industry. A negative EPS during a widespread economic downturn might not be as concerning as it is in a booming economy. And, as always, utilising a combination of financial ratios and tools will yield the most accurate perspective.

Flashcards in Earnings Per Share48

Start learningWhat is the definition of Earnings Per Share (EPS)?

Earnings Per Share (EPS) is the portion of a company's profit allocated to each outstanding share of common stock. It's often used as an indicator of a company's profitability.

How does Earnings Per Share (EPS) influence corporate finance?

EPS is important in corporate finance as analysts consider it when deciding whether to invest in a company's stock. Companies aim to keep their EPS high as it can directly impact investor perceptions.

Can a company's Earnings Per Share (EPS) increase?

Yes, a company's EPS can increase, either through an increased net income, a reduction in its outstanding shares, or both.

What is the impact of an Earnings Per Share increase on investors?

An increase in EPS could signal that a company is becoming more profitable, possibly leading to higher dividends and capital appreciation for investors.

What is the formula used to calculate Earnings Per Share (EPS)?

EPS = (Net Income - Dividends on Preferred Stock) / Number of Outstanding Shares.

What does each component in the Earnings Per Share (EPS) formula represent?

Net Income is a company's profit, Dividends on Preferred Stock are earnings paid to preferred shareholders, and Number of Outstanding Shares are the shares held by shareholders.

Already have an account? Log in

Open in AppThe first learning app that truly has everything you need to ace your exams in one place

Sign up to highlight and take notes. It’s 100% free.

Save explanations to your personalised space and access them anytime, anywhere!

Sign up with Email Sign up with AppleBy signing up, you agree to the Terms and Conditions and the Privacy Policy of StudySmarter.

Already have an account? Log in