StudySmarter - The all-in-one study app.

4.8 • +11k Ratings

More than 3 Million Downloads

Free

Americas

Europe

Dive headfirst into the world of Business Studies and gain an in-depth understanding of the IRR Rule, a pivotal aspect of financial management. This comprehensive article unfolds every facet of the IRR rule, from its basic concept to its diverse application in corporate finance. You will uncloak the utility of the IRR decision rule in making informed business decisions, compare it with the net present value, and scrutinise the finer points of the Incremental IRR rule. Discover the practical aspects of the IRR Acceptance rule, coupled with real-world examples and case studies. A rich learning experience awaits you as you explore the IRR rule's impact on pivotal business decisions.

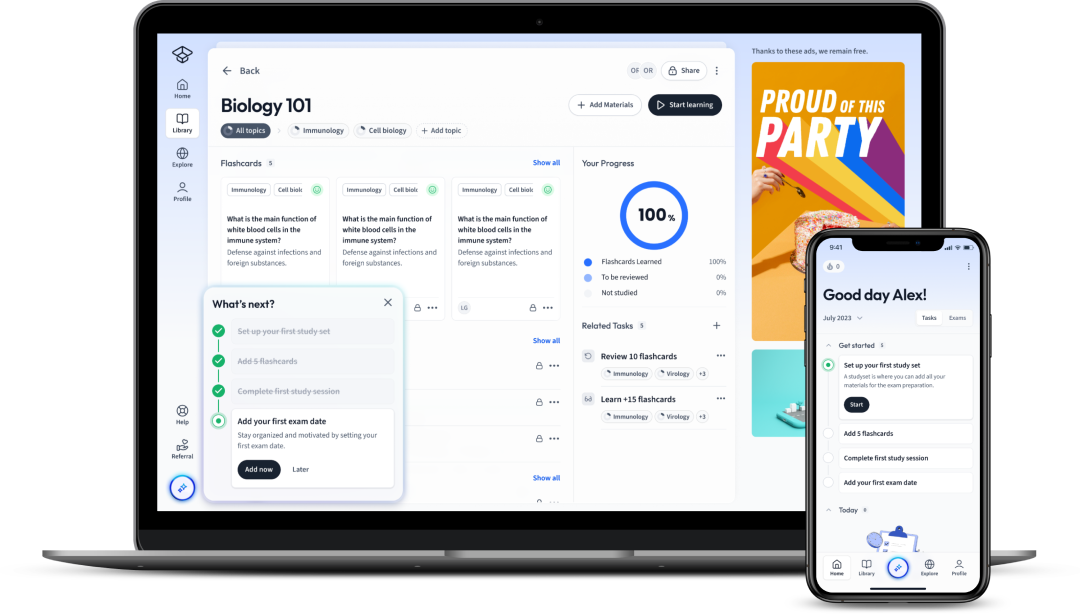

Explore our app and discover over 50 million learning materials for free.

Lerne mit deinen Freunden und bleibe auf dem richtigen Kurs mit deinen persönlichen Lernstatistiken

Jetzt kostenlos anmeldenDive headfirst into the world of Business Studies and gain an in-depth understanding of the IRR Rule, a pivotal aspect of financial management. This comprehensive article unfolds every facet of the IRR rule, from its basic concept to its diverse application in corporate finance. You will uncloak the utility of the IRR decision rule in making informed business decisions, compare it with the net present value, and scrutinise the finer points of the Incremental IRR rule. Discover the practical aspects of the IRR Acceptance rule, coupled with real-world examples and case studies. A rich learning experience awaits you as you explore the IRR rule's impact on pivotal business decisions.

The Internal Rate of Return (IRR) rule is a significant concept in the field of Business Studies, especially in the realm of financial management and corporate finance. This principle is a widely-used decision-making tool that assists businesses in determining whether a project or investment is worth pursuing.

The IRR can be defined as the discount rate that makes the net present value (NPV) of all cash flows (both positive and negative) from a project or investment equal to zero. It is a method used to evaluate the attractiveness of a project or investment. If the IRR of a new project exceeds a company’s required rate of return, the project is considered a good choice.

Assume a company is considering an investment which costs £500,000 and is expected to generate £150,000 annually for five years. By using the IRR rule, the company can calculate the rate of return it will receive if it goes forward with the investment. If the IRR exceeds the cost of capital, the company will likely proceed with the project.

Interestingly, the IRR rule is regarded as a golden rule in finance due to its widespread application. However, it's also the subject of a protracted debate because of the limitations it possesses in specific application scenarios, such as non-conventional cash flows and mutually exclusive projects.

In the realm of business studies, the Internal Rate of Return (IRR) decision rule plays a significant role by enabling businesses to efficiently make important investment decisions. This rule essentially involves calculating the IRR and comparing it with the "hurdle rate", or the required rate of return. If the IRR exceeds the hurdle rate, the project is considered favourable; conversely, if it falls below the threshold, the project is rejected.

The IRR decision rule is incredibly powerful in practical financial matters as it helps businesses identify profitable investment opportunities. It is most commonly applied in capital budgeting, corporate finance, and investment analysis. Here, we will elucidate the application step by step:

First and foremost, you would calculate the IRR of a potential investment based on projected cash flows. This is usually done using the following formula: \[ IRR = \left(1 + \frac{NPV}{Investment}) ^ {\frac{1}{n}}\right) - 1 \] In this formula, NPV stands for Net Present Value, n refers to the period, or number of units of time, and Investment refers to cost of capital tied up in the project. Once you have the IRR value, you would compare it with the required rate of return or hurdle rate. This rate is the minimum acceptable rate of return on an investment. If your IRR exceeds the hurdle rate, the investment is financially viable; if not, it should be rejected. This rule of thumb also applies to multiple potential investments - the ones with the highest IRR scores are typically deemed the most attractive. A crucial point to remember is that the IRR rule is beneficial in an environment that involves consistent cash flows and one that is free from drastic changes. It can lead to less reliable results when dealing with investments where the cash flow pattern is irregular or fluctuates significantly.The IRR rule and the Net Present Value (NPV) are two closely linked concepts, both of which are invaluable for decision-making in corporate finance. Let's delve into comparing the two:

NPV calculates the difference between the present value of cash inflows and outflows over a specific period of time, while the IRR is the rate at which NPV equals zero. While both methods provide a measurement for the profitability of a given investment, they do so from slightly different angles. The IRR rule gives the rate of return at which an investment breaks even, whereas NPV gives a raw value of the expected profitability in currency units. It's worth noting that while the IRR rule provides a percentage which can be intuitively understood, the NPV can provide a more accurate measure of a project's anticipated profitability. This is because unlike the IRR, the NPV doesn't assume the rate at which the company can reinvest its profits. Therefore, while both methods are potent tools, they should be used in conjunction to make informed decisions. It's essential to apply discretion, understanding each method's pros and cons, making sure the tool used aligns with the specific context and assumptions of the investment scenario. Ultimately, it's not a question of preferring one over the other; it's about knowing when the IRR or the NPV would provide the most accurate insight into investment profitability.In the landscape of financial management, understanding the implications of the Incremental Internal Rate of Return (IIRR) rule is of utmost importance, especially when it comes to making investment decisions between mutually exclusive projects. This rule essentially takes the IRR concept a step further and addresses some limitations of the standard IRR rule.

The Incremental Internal Rate of Return, also known as the IRR of differences, is an extension of IRR and is used to analyse and compare the financial viability of two mutually exclusive projects. To comprehend the Incremental IRR rule in its entirety, it is crucial to dissect it into its fundamental components.

The Incremental IRR is the rate at which the difference of the cash flows between two projects equals zero.

In business studies, the Internal Rate of Return (IRR) acceptance rule is an essential concept within the domain of financial management. It serves as a strategic tool, helping businesses make investment decisions that drive growth and expansion.

To adequately grasp the IRR acceptance rule, it is important to dissect its core meaning and implications. The IRR acceptance rule defines a guideline for accepting or rejecting a project or investment based on the value of its internal rate of return.

The Internal Rate of Return (IRR) is the discount rate that equates the net present value (NPV) of all projected cash flows to zero. In other words, it is the rate that makes the inflow and outflow of an investment even out over time.

The functional essence of the Internal Rate of Return (IRR) rule can truly be appreciated through praxis. Through real-world illustrations, the concept evolves from theory into an important procedure for evaluating investment projects noteworthy to businesses in their decision-making process.

To exemplify the calculated application of the IRR rule, two case studies have been selected which exhibit different business scenarios and investment proposals.

Case Study 1: Imagine Astra Corp Ltd, a technology-driven company looking forward to upgrading its server infrastructure. The upgrade is projected to cost £500,000 with the expected net cash inflows over the next five years as follows: Year (1) £120,000, Year (2) £160,000, Year (3) £200,000, Year (4) £230,000 and Year (5) £250,000.

Case Study 2: On the flip side, envision Orion Pharmaceuticals, a pharmaceutical company deciding on investing £300,000 into research and development for a new drug, with expected profits in the upcoming five years distributed as: Year (1) £60,000, Year (2) £80,000, Year (3) £120,000, Year (4) £150,000 and Year (5) £200,000.

Both these cases involve a significant initial outlay of funds followed by years of expected cash inflows. The company should employ the IRR rule to weigh each proposal's economic viability.

The IRR would be calculated as the discount rate (\(i\)) at which the Net Present Value (NPV) of all project's cash flows (both outflow and inflow) equals zero. It can be mathematically formulated as follows:

\[ 0 = \sum_{t=0}^{n} \frac{CF_t} {(1+i)^t} \] where \(CF_t\) are the cash flows at time \(t\) and \(n\) is the anticipated project's lifespan.Now, let's analyse how the information gathered from applying the IRR rule impacts the decision-making process of Astra Corp Ltd and Orion Pharmaceuticals. Calculation of the IRR for each investment proposal will provide an annual return rate expected from each investment.

A higher IRR would indicate a potentially more profitable project to undertake. If the computed IRR exceeds the company's minimum required rate of return (also known as the cost of capital), it signals the project's acceptance, otherwise it's rejection.

The IRR rule influences the decision-making process by providing a clear comparison criterion for judging different projects related to their rate of return. However, it simplifies an often complex decision by reducing it to a singular financial metric.

It's important to remember that while powerful, the IRR rule is best used in conjunction with other decision-making tools and plenty of judgment. For instance, qualitative factors like the strategic fit of the project within a company's overall goals or the project's potential risks might outweigh an attractive IRR.

Thus, while understanding how the IRR rule shapes business decisions is important, acknowledging its limitations and exact usage in a broader decision-making framework is equally essential to making sound investment choices.

Flashcards in IRR Rule15

Start learningWhat is the Internal Rate of Return (IRR) rule?

The IRR can be defined as the discount rate that makes the net present value (NPV) of all cash flows from a project or investment equal to zero. If the IRR of a new project exceeds a company’s required rate of return, the project is considered worthy.

What are some limitations of the IRR rule?

The IRR rule can give misleading decisions when comparing projects of different scale and timing of cash flows, it assumes a constant reinvestment rate and lacks consideration of the cost of capital.

How can the IRR rule be employed in corporate finance?

Corporations can use the IRR rule to compare different investment options and determine the most profitable project to undertake. It can decide whether to invest in long-term projects or buy new equipment.

What is the Internal Rate of Return (IRR) decision rule used for in businesses?

The IRR decision rule is used to make important investment decisions in businesses. It involves calculating the IRR and comparing it with the hurdle rate or the required rate of return. Investments are considered favourable if the IRR exceeds the hurdle rate.

How do you apply the IRR decision rule?

You calculate the IRR of a potential investment based on projected cash flows, compare it with the required rate of return or hurdle rate. If the IRR exceeds the hurdle rate, the investment is financially viable, if not it should be rejected.

How does the IRR rule compare with the net present value (NPV) method?

While both measure investment profitability, their approaches differ: IRR gives the rate of return at which an investment breaks even, while NPV gives the raw expected profitability in currency units. They should be used together for comprehensive insight.

Already have an account? Log in

Open in AppThe first learning app that truly has everything you need to ace your exams in one place

Sign up to highlight and take notes. It’s 100% free.

Save explanations to your personalised space and access them anytime, anywhere!

Sign up with Email Sign up with AppleBy signing up, you agree to the Terms and Conditions and the Privacy Policy of StudySmarter.

Already have an account? Log in