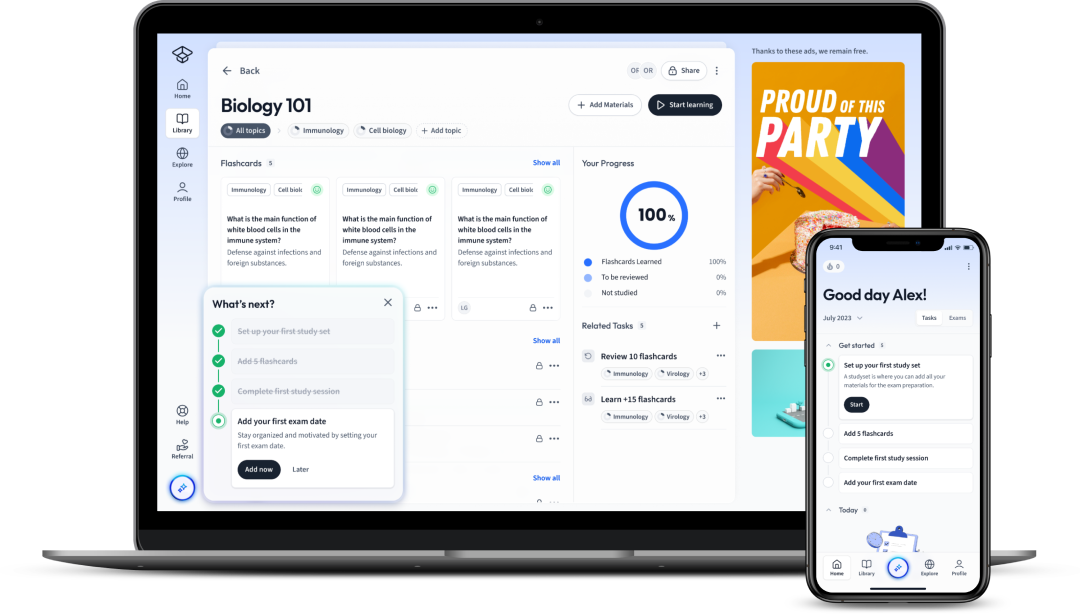

StudySmarter - The all-in-one study app.

4.8 • +11k Ratings

More than 3 Million Downloads

Free

Americas

Europe

The collapse of the energy company in December 2001 investigated what would become the most complex white-collar crime in the FBI's history. "

Explore our app and discover over 50 million learning materials for free.

Lerne mit deinen Freunden und bleibe auf dem richtigen Kurs mit deinen persönlichen Lernstatistiken

Jetzt kostenlos anmeldenThe collapse of the energy company in December 2001 investigated what would become the most complex white-collar crime in the FBI's history. "

- fbi.gov

Let's take a look at how such a large and promising company ended up giving way to one of the largest accounting scandals in history; resulting from various financial malpractices, accounting issues and eventually leading to the collapse of Enron.

Enron Corporation was founded in 1985 as a result of a merger between Houston Natural Gas Corporation and InterNorth Inc. Enron soon became one of the largest suppliers of natural gas and electricity. However, during the merger, the company incurred a significant amount of debt due to a new law passed by the US Congress. The law deregulated the sale of natural gas, meaning that Enron lost its exclusive rights to its pipelines.

Deregulation is the removal of regulations or restrictions in a certain industry.

To survive this loss, the company had to quickly create a new business strategy that would generate cash flow and profits.

Jeffrey Skilling, who previously worked as a consultant, was appointed chief executive of Enron. Shortly after his appointment as an executive, the company started generating massive profits and gaining substantial market share. A few years later, Jeffrey Skilling was convicted of 18 counts of conspiracy and fraud, in addition to insider trading. Let's take a look at what happened.

The Enron scandal may be approached from multiple different perspectives. Firstly, from an accounting point of view, Enron's accounts were manipulated whereby huge amounts of debt were 'hidden' from the company's balance sheet. The company also announced substantial financial losses and shareholders' equity decreased by over a billion dollars in a short period of time. The company eventually announced bankruptcy and share prices decreased from $90 to under $1 almost within a year.

The share price is the amount it would cost an investor to buy one share in the company.

From another point of view, Enron's internal culture also became increasingly questionable and toxic. Jeffrey Skilling implemented a performance review community (PRC), which eventually became known as one of the strictest employee ranking methods. The review was originally based on the company's core values of respect, integrity, communication, and excellence; however, eventually, employees interpreted that the PRC was based on the amount of profit they could individually bring the company. Employees with 'bad' scores were fired within a couple of months, whereas employees with 'good' scores were promoted. Under Skilling's management, around 15% of the workforce was replaced annually.

Find out more on how this impacts employee performance in our organisational culture and leadership explanations.

Some theorists believe that the Enron accounting scandal began when Skilling implemented the mark-to-market (MTM) accounting system. This new method of accounting replaced the previously used historical cost accounting system. MTM is based on fair value rather than actual costs. Estimating an account's fair value is more difficult than establishing actual costs.

Mark-to-market (MTM) measures the fair value of a company's accounts and aims to result in a realistic appraisal of the company's current financials; however, it can also be manipulated, as in the case of Enron.

Let's take a closer look at how this system works and how it was manipulated by Enron. Initially, the company would create an asset (like a power plant) and instantly claim a profit on its books even if the asset had not resulted in any profit for the time being. Instead of considering actual profits, the company used the projected profits for its accounting. If the actual revenue ended up being less than the projected profit, the company would transfer the asset to a completely different 'off-the-books' company and fail to report the losses. This accounting system allowed the company to write off unprofitable ventures without impacting its official net income.

As a refresher, take a look at our explanations on profit, cash flow and budget.

Now, let's take a look at how the huge amount of debt was hidden from investors and creditors.

A special purpose vehicle (SPV), or special purpose entity (SPE), is a subsidiary company created by a parent company to mitigate risks. As the SPE is a separate legal entity from the parent company, it remains financially secure even if the parent company goes bankrupt.

Find out more about how this form of business can operate by reading our explanation on limited liability.

As the SPE has its own balance sheet, it can also be used as a means of managing risky ventures, meanwhile mitigating any impact on the parent company's financials.

A balance sheet or a statement of financial position shows the assets, liabilities, and shareholder's equity of a business at a specific point in time (usually the end of the financial period). Here, the assets are resources controlled by the business and the liabilities are obligations of the business.

In the case of Enron, SPEs were used to hide debt and manipulate their accounting. When Enron needed cash, it would set up an SPE, which could secure a loan from the bank. The cash from the loan would then be transferred to Enron. This way, Enron could hide debt from its balance sheet, as they (the parent company) were not the ones acquiring the debt on their balance sheet.

The problems began surfacing in 2001 when analysts started looking into Enron's financial statements. In the third quarter of 2001, Enron announced a $638 million loss and a $1.2 billion reduction in shareholders' equity. We can infer that Enron was hiding over a billion dollars of debt on their financial statements. After the announcement, the Securities and Exchange Commission (SEC) began investigating all transactions between Enron and the SPVs.

As the accounting issues began surfacing, representatives from Enron's accounting firm began destroying documents related to Enron's finances.

When the scandal surfaced and Enron collapsed, $74 billion of shareholder funds, pensions, and the jobs of thousands of employees were gone.

The FBI also began investigating the case. Due to the case's large volume, a multi-agency task force of investigators, analysts, the Internal Revenue Service Investigation Division, the SEC, and prosecutors were created and termed the 'Enron Task Force'.

Thousands of interviews were conducted, thousands of boxes of evidence were seized, twenty-two people were convicted and more than $164 million was seized to compensate victims of the Enron scandal.

In a Wall Street Journal article written by Joe Berardino, a managing partner, and CEO of Andersen, Berardino states that there are numerous issues that need to be addressed, including:

accounting standard,

Modernizing the financial reporting model,

reforming the regulatory environment,

Improving accountability across the capital system.

The Enron scandal did, eventually, lead to new regulations in the financial system. In July 2002 the Sarbanes-Oxley Act was signed, which increased penalties for the destruction and fabrication of financial statements, in addition to attempts by tricking stakeholders. The scandal also led to new compliance measures, such as the Financial Accounting Standards Board (FASB) increasing the importance of ethical conduct. Company directors have also become more independent, decreasing the chance of them trying to manipulate profit and hide debt. Independent directors monitor the audit companies and have the power to replace unethical managers.

These new measures are important to keep in place in order to prevent future financial and accounting scandals in large companies.

In its early days, Enron was one of the largest suppliers of natural gas and electricity.

The company incurred a significant amount of debt when a new law deregulated the sale of natural gas.

As a result, Enron had to create a new business strategy to generate profit.

Enron's accounts were manipulated whereby huge amounts of debt were 'hidden' from the company's balance sheet.

Organizational culture became increasingly toxic.

The market-to-market (MTM) accounting system, the creation of special-purpose entities (SPEs) and a high cost of capital all played a role in Enron's hiding of debt and ultimately the downfall of the company.

The problems began surfacing in 2001 when analysts started looking into Enron's financial statements. In the third quarter of 2001, Enron announced a $638 million loss and a $1.2 billion reduction in shareholders' equity.

The Enron Task Force began investigating the case and ended up convicting over twenty people.

The Enron scandal eventually led to new regulations in the financial system.

References:

Journal of Accountancy: The Rise and Fall of Enron. https://www.journalofaccountancy.com/issues/2002/apr/theriseandfallofenron.html

The New York Times: Jeffrey Skilling Released After 12 Years in Prison. https://www.nytimes.com/2019/02/22/business/enron-ceo-skilling-scandal.html

FBI: Enron. https://www.fbi.gov/history/famous-cases/enron

The problems began surfacing in 2001 and Enron ceased operations in 2007.

The effects of the Enron scandal are:

In its early days, Enron was one of the largest suppliers of natural gas and electricity. The company incurred a significant amount of debt when a new law deregulated the sale of natural gas. As a result, Enron had to create a new business strategy to generate profit. Enron's accounts were manipulated whereby huge amounts of debt were 'hidden' from the company's balance sheet. Organizational culture became increasingly toxic. The market-to-market (MTM) accounting system, the creation of special-purpose entities (SPEs) and a high cost of capital all played a role in Enron's hiding of debt and ultimately the downfall of the company.

The Enron scandal began surfacing in 2001 when analysts started looking into Enron's financial statements. In the third quarter of 2001, Enron announced a $638 million loss and a $1.2 billion reduction in shareholders' equity.

The market-to-market (MTM) accounting system, the creation of special-purpose entities (SPEs) and a high cost of capital all played a role in Enron's hiding of debt and ultimately the downfall of the company.

Flashcards in Enron Scandal23

Start learningWhat industry did Enron operate in?

The natural gas industry.

Why did Enron have to create a new business strategy?

Enron had to create a new business strategy because the sale of natural gas was deregulated.

What were the two main problems at Enron?

Accounting and organisational culture.

What is mark-to-market (MTM) accounting?

MTM measures the fair value of a company's accounts and aims to result in a realistic appraisal of the company's current financials, however, it can also be manipulated, as in the case of Enron.

What is a special purpose entity (SPE)?

A special purpose vehicle (SPV), or special purpose entity (SPE), is a subsidiary company created by a parent company to mitigate risks.

What types of new standards did the Enron scandal lead to?

It led to new regulations in the financial system.

Already have an account? Log in

Open in AppThe first learning app that truly has everything you need to ace your exams in one place

Sign up to highlight and take notes. It’s 100% free.

Save explanations to your personalised space and access them anytime, anywhere!

Sign up with Email Sign up with AppleBy signing up, you agree to the Terms and Conditions and the Privacy Policy of StudySmarter.

Already have an account? Log in