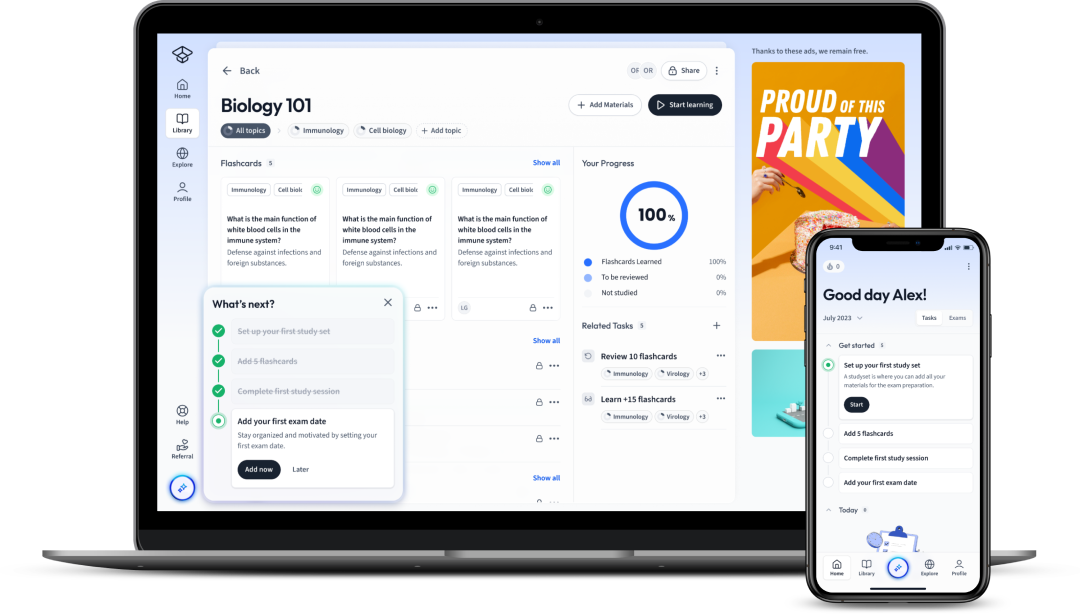

StudySmarter - The all-in-one study app.

4.8 • +11k Ratings

More than 3 Million Downloads

Free

Americas

Europe

Did you know that in 2021 a £31 billion merger between the telecommunication giants Virgin Media and O2 occurred? Let's take a look at this case for more information about this merger and how it may impact our lives.

Explore our app and discover over 50 million learning materials for free.

Lerne mit deinen Freunden und bleibe auf dem richtigen Kurs mit deinen persönlichen Lernstatistiken

Jetzt kostenlos anmeldenDid you know that in 2021 a £31 billion merger between the telecommunication giants Virgin Media and O2 occurred? Let's take a look at this case for more information about this merger and how it may impact our lives.

Throughout the explanation, we will be conducting a strategic analysis. The analysis will involve SWOT and financial analysis to conduct an in-depth examination of the merger.

The SWOT analysis has two types of elements external and internal.

The internal analysis includes:

Strengths – These are the things the business is good at and has a competitive advantage in. It can be human resources such as employing many talents, strong brand image, consumer loyalty etc.

Weaknesses –These include internal things that the business is lacking, and may be harmful to the organisation. For example, debt, lack of using new technology etc.

The external analysis includes:

Opportunities – Businesses cannot control these factors but they are beneficial for the organisation. These may include new technology, lower production costs abroad etc.

Threats – These include external factors that may be harmful to the organisation. For example, competitors entering the market.

The financial performance analysis involves an income statement that indicates the company's revenues earned and the expenses incurred over a period of time.

On the other hand, a balance sheet also known as the statement of financial positioning shows the assets and liabilities of a company for a specific period.

Additionally, financial ratios are also used to analyze a company's financial performance, they include return on capital employed, net profit margin, gross profit margin and current ratio.

To revise these concepts, take a look at our explanation of financial performance.

Before Virgin media was created, Virgin Mobile, the UK phone network was established in 1999 by Richard Branson. The other companies that were strongly competing in the cable market were NTL and Telewest that have merged together and acquired Virgin Mobile for £ 962 million in 2006. In 2007 the merged company NTL Telewest had named the whole company Virgin Media.

In 2013, Virgin Media along with other Virgin brands was acquired by Liberty Global which is the world's biggest broadband company, that operates in more than 10 European countries.

Currently, Virgin Media provides services such as phone, broadband internet, and television services over the cable network.

Moreover, Virgin Media's CEO from 2019 and Virgin Media-O2's CEO from 2021 is Lutz Schüler.

It is crucial to identify the strengths of Virgin Media as it will help to explain what Virgin Media has to offer to the merger. The key strengths are:

Virgin Media's opportunities include the following:

On the other hand, external threats to Virgin Media include:

Virgin Media's weaknesses are things that the company should improve on. We can also think about how the merger with O2 may help the company turn those weaknesses into strengths. They include:

O2 was founded in 1985 in London and was acquired by Spanish telecommunication company Telefónica in 2005. Mark Evans is the current CEO of O2. Moreover, O2 is a leading mobile communications company in the UK, as it has over 36.2 million customers across its operations. O2 runs various networks from 2G all the way to 5G. In addition to owning over 450 retail stores and O2 Academy venues, the O2 is also the English rugby team's main sponsor.

Virgin Media-O2 was created in June 2021 through a 50:50 joint venture between Liberty Global and Telefónica, the owners of Virgin Media and O2. The official name of the Virgin Media and O2 merger company is VMED O2 UK Limited. In short, this merger is called by its business's initials which is VMO2.

The Virgin Media O2 merger is one of the largest broadband, mobile, TV, and home mergers that has ever been encountered. One of the main goals of the merger is to keep up with the new 5G technology and ensure that the majority of customers can use it.

It is important to know that before the merger, Virgin Media was a subsidiary of Liberty Global, whereas O2 was a subsidiary of Telefónica. After the merger, both companies are 50% owned by Liberty Global and 50% by Telefónica.

The Virgin Media and O2 logos have been merged in order to create a Virgin Media-O2 logo. The logo is designed in the shape of the Virgin Media logo and is similar to the shape of the infinity symbol. Virgin Media-O2's logo can be easily recognised by consumers who already know at least one of the two companies involved in the merger.

Looking at the logo design from the marketing point of view, the combination of two logos with no direct changes was influenced by already existing strong brand recognition from both providers Virgin Media and O2. This is one of the reasons why logos were combined instead of developing a new logo for the Virgin Media-O2 merger.

Virgin Media-O2 has developed a new service product called Volt which involves more benefits than Virgin Media and O2 offers separately. The Volt plan allows customers to use double data on the O2 monthly mobile plan and the fastest broadband from Virgin Media that is available in the area. Additionally, the Volt plan allows consumers to use the O2 WI-FI with no additional costs as well as offers a £ 150 discount on the O2 custom plan.

We will analyze this strategic move of introducing a new service product using SWOT analysis. First, the main objective of this strategy was to offer consumers the convenience of being able to use the services of both providers with one contract and to get extras such as faster internet or more data, which are the main strengths of this service product.

In addition to the merger's benefits for consumers using the Virgin Media-O2 services, Virgin Media customers can now use the O2 priority rewards scheme app, previously only available to O2 customers.

As we have seen in the previous sections, both companies including O2 and Virgin Media have strengths and opportunities that can be beneficial for the merger to thrive, as well as weaknesses and threats that the merger may be able to overcome. Now we shall use SWOT analysis to examine Virgin Media-O2 in great detail.

In order to fully understand how Virgin Media-O2 engages in investor relations, let's define the meaning of investor relations first.

Investor relations is the type of strategic management that is aimed at strengthening communication between the company and the financial community in order to attract investment.

Key functions of investor relations are sharing financial information, communicating with stakeholders, and marketing.

The way Virgin Media-O2 (VMO2) maintains positive relations with investors is by publishing financial results on its website for each quarter. These financial results are organised into key categories such as:

Fixed-line customers

This category involves consumers that use a minimum of one broadband service offered by VMO2 which can include broadband, TV or home phone services. These statistics exclude any mobile services used.

Total mobile connections

In summary, the merger between Virgin Media and O2 was a successful strategy from the perspective of both companies. The merger capitalised on the strengths of the merged companies, as Virgin Media's innovation edge enabled the merger to be very innovative and develop a service product called 'Volt'.

In addition, Virgin Media O2 capitalised on O2's strengths and provided a leading mobile network for its customers. As the merger has been developed by combining two well-known companies, this has resulted in great brand recognition and customer loyalty.

Overall, the strategy of combining two companies by offering both mobile and broadband services as a single company is a great move. This way O2 customers are likely to use Virgin Media and vice versa, as it is cheaper to use both services than to use each separately. In this way, Virgin Media-O2 will be able to generate higher revenues and compete against other providers who only offer one of the two services.

These statistics include the number of active sim cards within Virgin Media and the O2 mobile network.

In the analysis of financial performance, the statement of "Fixed-line consumers" and "Total mobile connections" shows the potential profits of the company that can be generated from these segments. The sections "Total adjusted revenue" and "Transaction adjusted EBITDA" show the revenue and adjust it by deducting expenses and any costs that have been incurred.

Total adjusted revenue

Accounting adjustments are used to accurately represent revenue in regard to the company's operations.

Transaction Adjusted EBITDA

This refers to a measure of profitability in regards to earning less interest, taxes, depreciation and amortisation.

This financial analysis is crucial for disclosure by the company, as it shows the profits and overall financial health of the company and can therefore strongly influence investors' investment decisions.

Additionally, Virgin Media-O2 provides links to Liberty Global's and Telefonica's websites that contain investor relations materials, including news, events, and other important information.

The Liberty Global website has a section titled 'Sustainability', which shows investors how the 5G network is responsible and sustainable in terms of communities and the environment.

This type of information, in addition to financial reports, keeps investors engaged as well as assists to predict companies' future performance based on news, events etc.

Virgin Media-O2 clearly spotted the opportunity to combine services. Getting existing customers to use both services rather than just one. This will have a positive impact on both the Virgin Media-O2 merger and on both companies individually. In addition, another opportunity for the company is to continue developing innovative features for this service product.

Weaknesses and threats of this product are that regardless of the benefits that the Volt plan offers, it may be a little bit pricey and lengthy for some consumers. Therefore, competitors may try to copy the idea and attempt to replicate it for a more affordable price.

This name is given to the merger because it clearly highlights the companies involved in the merger. The reason for this is that Virgin Media and O2 are already widely known to consumers. If the company is known to customers, they are likely to recognise it, trust it, and become consumers of it.

Sources:

1. VirginmediaO2: Q3 2021 financial results.

2. O2 (Telefónica UK) Linkedin, About, 2021

3. GOV.UK: VMED O2 UK LIMITED

4. Virgin Media: Our history & Liberty Global

In 2021, telecommunication giants Virgin Media and O2 merger occurred.

Virgin Media-O2 was created in June 2021 through a 50:50 joint venture between Liberty Global and Telefónica, the owners of Virgin Media and O2.

Virgin media- O2 merged in June 2021. The official name of the Virgin Media and O2 merger company is VMED O2 UK Limited. In short, this merger is called by its business's initials which is VMO2.

One of the main goals of the merger is to keep up with the new 5G technology and ensure that the majority of customers are able to use it.

After the merger, Virgin Media customers can use the O2 priority rewards scheme app, previously only available to O2 customers.

Yes, Virgin and O2 have merged. Virgin Media-O2 was created in June 2021 through a joint venture between Liberty Global and Telefónica. The official new name of the Virgin Media and O2 merger company is VMED O2 UK Limited.

Flashcards in Virgin Media O2 Merger28

Start learningWhich companies were involved in the Virgin media-O2 merger?

The companies involved in the merger were Virgin Media and O2.

Who owns Virgin Media-O2?

Virgin Media-O2 is owned by 50% Liberty Global and 50% Telefónica.

What was the main goal of the Virgin Media and O2 merger?

The main goal was to keep up with 5G technology and ensure that it is accessible to the majority of consumers.

Who is the CEO of Virgin media-O2?

The CEO of Virgin media-O2 is Lutz Schüler.

What was the name of Virgin’s telecommunication service that was found before Virgin Media?

Virgin Mobile.

When was Virgin Media created?

Virgin Media was created in 2007.

Already have an account? Log in

Open in AppThe first learning app that truly has everything you need to ace your exams in one place

Sign up to highlight and take notes. It’s 100% free.

Save explanations to your personalised space and access them anytime, anywhere!

Sign up with Email Sign up with AppleBy signing up, you agree to the Terms and Conditions and the Privacy Policy of StudySmarter.

Already have an account? Log in