StudySmarter - The all-in-one study app.

4.8 • +11k Ratings

More than 3 Million Downloads

Free

Americas

Europe

Dive into an in-depth exploration of the Capital Asset Pricing Model, an essential financial theory widely utilised in the realm of corporate finance. This article offers thorough insight into the fundamentals, formula, and significant components of the Capital Asset Pricing Model. It further explicates how assumptions influence this model and showcases a clear grasp of the international dimensions in its application. Addressing both its advantages and limitations, this resource also illustrates how corporations can harness it for maximum benefits. Get a real-life perspective through intriguing case studies highlighting the practical applications of this potent business tool. This is your comprehensive guide to understanding and making the most out of the Capital Asset Pricing Model.

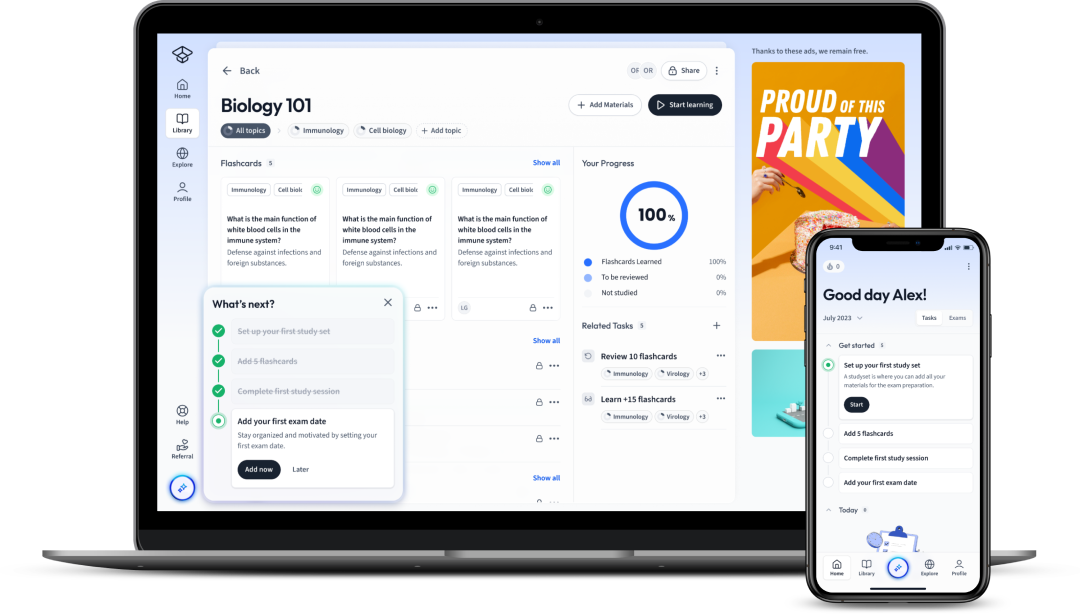

Explore our app and discover over 50 million learning materials for free.

Lerne mit deinen Freunden und bleibe auf dem richtigen Kurs mit deinen persönlichen Lernstatistiken

Jetzt kostenlos anmeldenDive into an in-depth exploration of the Capital Asset Pricing Model, an essential financial theory widely utilised in the realm of corporate finance. This article offers thorough insight into the fundamentals, formula, and significant components of the Capital Asset Pricing Model. It further explicates how assumptions influence this model and showcases a clear grasp of the international dimensions in its application. Addressing both its advantages and limitations, this resource also illustrates how corporations can harness it for maximum benefits. Get a real-life perspective through intriguing case studies highlighting the practical applications of this potent business tool. This is your comprehensive guide to understanding and making the most out of the Capital Asset Pricing Model.

The Capital Asset Pricing Model (CAPM) is a vitally important concept in financial studies, as it impacts the world of investment, financial analysts, and portfolio managers. In simple terms, CAPM is an economic model that establishes a relationship between risk and expected return on an investment. In other words, it provides you a method to calculate the appropriate required rate of return of an asset.

Definition: Capital Asset Pricing Model (CAPM) is an economic model that describes the relationship between systematic risk and expected return on assets, especially stocks. It is broadly used to determine a theoretically appropriate required rate of return of an asset.

The fundamentals of CAPM boil down to its core equation, which you may express as:

\[ \text{ER}_i = R_f + \beta_i(\text{ER}_m - R_f) \]Where:

Example: Assume a risk-free rate of 2%, a market return of 8% and a beta of 1.3 for the asset. Calculating the expected return using the CAPM formula yields: ER = 2% + 1.3 * (8% - 2%) = 9.8%. So, an investor would require a return of 9.8% to take on the risk of this investment.

The three major components of the Capital Asset Pricing Model are the risk-free rate, beta (β), and expected market return.

| Component | Description |

| Risk-free rate (Rf) | This represents the rate of return for an investment with zero risk. Typically, the interest rate offered by a risk-free or a very low-risk investment such as a government treasury bill is considered the risk-free rate. |

| Beta (β) | Beta represents the risk of an investment. More specifically, it measures an investment's volatility or its systematic risk in comparison to the market. In practical terms, a beta value of less than 1 means the investment is less volatile than the market, while a beta value greater than 1 implies more volatility. |

| Expected Market Return (ERm) | This is the return that investors expect to earn from the market over a specific period. The overall market return is usually represented by a broad market index, such as the S&P 500. |

The CAPM assumptions relate to how markets behave and how investors make decisions.

Deep Dive: Based on the ideas of Harry Markowitz's Modern Portfolio Theory (MPT), the CAPM theory has a set of assumptions that underline how it works in a perfect, theoretical world. However, in real-world finance, these assumptions do not always hold true, and hence it's crucial for you to understand them.

Below are the key assumptions the Capital Asset Pricing Model is based on:

The assumptions of CAPM provide the model with its simplicity and elegance. They also represent a significant source of critique, as they don't quite mirror the realities of financial markets and decisions.

Definition: A critique of CAPM often centres around its assumptions. The model assumes markets are perfect and investors behave rationally, which is often not the case in the real-world financial markets.

For instance, if the assumption of no transaction cost were violated, you would have to adjust the expected return on an asset for transaction costs, making the model more complex. Similarly, if rational and risk-averse behaviour was not assumed, an investor might take more or less risk, causing deviations from the expected return predicted by the model. Understanding these assumptions enables a more nuanced interpretation of a CAPM analysis.

The Capital Asset Pricing Model is typically employed to calculate the expected return on an investment given its level of risk. The core formula of CAPM is an embodiment of the relationship between expected risk and expected return.

This crucial equation is expressed as:

\[ \text{ER}_i = R_f + \beta_i(\text{ER}_m - R_f) \]You'll find that the CAPM formula essentially depicts three crucial variables: \( R_f \), \( \beta_i \), \( \text{ER}_m \). Let's delve into what each variable represents.

The first component, \( R_f \), represents the risk-free rate. This is typically the yield of a government bond or treasury bill which is viewed as virtually free of default risk. The risk-free return is the minimum return you would expect for any investment, given that you require no compensation for risk.

Next, the \( \beta_i \) symbol stands for the beta coefficient. It measures a stock's volatility or systematic risk in comparison to the market as a whole. When beta equals one, it indicates that the investment's price will move with the market. If beta is less than one, the investment will be less volatile than the market. Conversely, if beta is more than one, the investment price will be more volatile than the market.

Finally, \( \text{ER}_m \) is the expected return of the market. This is essentially the average return investment professionals expect to earn from an investment in a broad market portfolio. It calls for a certain degree of speculation on the general direction of the economy and stock market.

When you're computing the \( \text{ER}_i \) element of the equation, you're effectively estimating the potential return on an investment, factoring in the prevailing risk-free interest rate, the asset’s risk-related beta coefficient, as well as the projected market return. There is an implicit understanding here that the higher the risk—in the form of a higher beta value formed from past price fluctuations—the higher the expected return. This risk-return tradeoff is a key principle of finance.

Let's break things down with a practical exercise to solidify your understanding of the Capital Asset Pricing Model.

Suppose you're considering an investment in a particular stock. You have access to the following figures:

Operating with this data and the formula we discussed above, you can find the expected return on the stock as follows:

\[ \text{ER}_i = R_f + \beta_i(\text{ER}_m - R_f) \] \[ \text{ER}_i = 0.02 + 1.5 (0.07 - 0.02) = 0.095 \]Therefore, the expected return on the stock is 9.5%. This figure suggests that, given the level of risk, investors require almost a 10% return to invest in this particular stock. If the actual or observed return were lower than this, investors would likely choose alternative investments.

Taking the time to dissect these calculations can help you better understand the innards of the Capital Asset Pricing Model formula and clarify how each core component operates. Just bear in mind that all these numbers often rely on estimation and provide only a guide, not a concrete prediction of investment performance.

In the world of corporate finance and investment management, the International Capital Asset Pricing Model (ICAPM) comes into play as a financial model for valuing risky securities and generating expected returns for assets given a specific risk. A significant advancement of the Capital Asset Pricing Model (CAPM), ICAPM incorporates additional factors to account for international investing, like exchange rates, in the pricing model.

The International Capital Asset Pricing Model greatly extends upon the original CAPM by considering the effects of foreign investments. While the CAPM formula only needs a risk-free rate, the beta of the stock or portfolio, and the expected market return, ICAPM goes a step further. Besides these factors, it takes into account exchange rate risk and country-specific risk, thereby providing a more robust, realistic model for today's globally interconnected financial markets.

The formula of ICAPM can be expressed as follows:

\[ \text{ER}_i = R_f + \beta_{im}(\text{ER}_m - R_f) + \beta_{ie}(\text{ER}_e - R_f) \]Where:

Essentially, ICAPM acknowledges that global investing involves risks not present in domestic investing, chiefly exchange rate risk and country-specific risk. Therefore, it adjusts its formula with more variables to account for such risks.

Example: In international investments, if currency exchange rates were to drastically change during the investment cycle, it would affect the final investment value. For instance, if an investor puts money into an asset denominated in euros, and the euro appreciates against their home currency, the investor stands to gain more when they convert their returns back into their home currency. ICAPM helps to capture this possibility.

Global influences have a significant impact on pricing models. As firms and investors increasingly span across various countries and regions, it's essential to factor in international elements to capture the complexities of the global market. Ignoring such influences can result in underestimating or overestimating expected returns, leading to suboptimal investment decisions.

Foreign exchange risk is one such influence. Changes in exchange rates can significantly affect a foreign investment's profitability. For instance, even if an asset performs well, a significant depreciation in that country's currency can wipe out all the returns when converted back to the investor's home currency. Likewise, appreciation in the foreign currency can boost the returns.

Another influence is the country-specific risk, which captures the inherent risk factors associated with investing in a specific country. These factors can include political instability, regulatory changes, economic fluctuations, and even sociocultural events. Any of these occurrences can directly impact the return on the investment.

The International Capital Asset Pricing Model not only factors in these global influences but also allows investors to consider how these aspects might affect the value of their portfolios. Notably, it points the way for investors to more effectively diversify their portfolios, spreading risk across borders and reducing their exposure to any single market. Moreover, it encourages investors to shop globally for the best investment opportunities, fostering the notion of a connected, integrated global financial market.

The Capital Asset Pricing Model, often abbreviated as CAPM, offers a host of benefits to both investors and corporations. Yet, it also has its limitations. In this article, you'll learn about the many advantages and potential drawbacks of the CAPM, what they mean for different stakeholders, and how these challenges are typically addressed.

One significant advantage of the Capital Asset Pricing Model is its ability to calculate the risk-adjusted return, giving you a clear understanding of the return you can expect given a specific level of risk. This essential tool offers invaluable insights to those seeking to balance the risk and return trade-off in their portfolio.

CAPM is additionally crucial for project selection. When a company has various projects to choose from, it can use the model to estimate the return it should require, given the risk of the project. Projects with a potential return less than what the model outputs would be considered unsatisfactory.

Risk-adjusted return: A measure of the profit or potential profit from an investment that takes into account the degree of risk that must be accepted in order to achieve it.

It's worth highlighting that the CAPM's reliance on beta, a measure of stock market risk, makes the model incredibly valuable. This model distinguishes itself by focusing not on the total risk of an investment but on its systematic risk - the risk that is intrinsic to the entire market and cannot be diversified away.

Lastly, CAPM's relative simplicity makes it highly favoured. Its straightforward formula allows for easy calculation and interpretation, making it accessible and beneficial to a wide range of users, from financial analysts to individual investors.

The benefits of using the Capital Asset Pricing Model aren't exclusive to investors. Corporations can find immense value in its use, particularly in the realms of project evaluation and corporate finance.

When selecting new projects or investments, corporations often turn to CAPM to estimate the return they should expect, given the risk associated with the potential venture. With this information at hand, they can make informed decisions about which projects to undertake and what kind of return they should anticipate.

CAPM is also instrumental in corporate finance for identifying a company's cost of equity. This key figure, which is the return required by an company's shareholders, is essential in assessing the attractiveness of new projects and investments. By providing a measure for cost of equity, CAPM aids businesses in determining whether a proposed project or investment will yield enough return to satisfy their shareholders.

Additionally, corporations can use CAPM to determine their capital structure or the optimal mix of debt and equity financing. As the model provides an understanding of the risk and return trade-offs, it guides corporations to select the right balance that minimises the cost of capital while maximising shareholder value.

While the Capital Asset Pricing Model is robust and widely utilised, it is not without its limitations. The model predominantly rests on certain assumptions that may not hold true in real-world scenarios, thus impacting its accuracy and applicability.

Firstly, CAPM assumes that investors are rational and risk-averse, focusing only on expected returns and standard deviation. However, in reality, investor behaviour often deviates from this rational model due to psychological biases.

Secondly, the model assumes that all investors have access to the same information and agree on the risk and expected return of all assets. This assumption of homogeneous expectations is rarely met — information availability and interpretation can vary widely among investors.

One of the most significant limitations is the model's reliance on 'beta' to measure an investment's risk. Critics argue that using beta does not encompass all dimensions of risk. Additionally, beta is based on historical data, which may not accurately predict future risk.

As we've examined, the Capital Asset Pricing Model has several limitations. To combat these issues and gain a more nuanced understanding of risk and return, many investors and corporations use a multi-factor approach. This approach, which extends the original CAPM, includes multiple factors that might impact an asset's return, such as company size, valuation ratios, and market trends.

For instance, to address the shortfalls of using only 'beta', alternative risk measures could be incorporated. These could include idiosyncratic volatility, price momentum, or financial distress probability — helping to create a more comprehensive risk profile for assets.

To counter the assumption of homogeneous expectations, investors could rely on a blend of consensus estimates and their own analyses to derive expected returns. Furthermore, advancements in behavioural finance offer additional insights into how investors actually behave, further improving our understanding of asset pricing.

It's critical to note that while these approaches help address some of CAPM's limitations, each alternative method has its own assumptions and drawbacks. As such, it's crucial to use these models as tools alongside your personal judgement and understanding of the market dynamics.

The Capital Asset Pricing Model (CAPM) is more than a theoretical financial model. It finds application in a diverse range of financial decisions, such as calculating required rates of return, estimating cost of equity, and analysis of capital budgeting from a corporate perspective.

In the realm of corporate finance, the Capital Asset Pricing Model serves as a pivotal tool in various decisions related to investments, cash flow, and risk assessment. Some of the most common areas of application are as follows:

Capital Budgeting: The process by which a business determines and evaluates potential major projects or investments.

Let us illustrate these applications with a theoretical example. Consider a corporation that is trying to decide whether or not to invest in a risky project. It uses CAPM to calculate the expected return of the project by plugging in the risk-free rate, the beta (systematic risk) of the project, and the expected market return into our CAPM formula. If the expected return surpasses the project's cost, the corporation may decide to proceed with the investment.

To truly illustrate the practical applications of the Capital Asset Pricing Model, let us delve into a real-life case study.

Suppose ABC Ltd., a technology firm contemplating a new software development project, wants to compute the cost of equity to assess whether the project is economically viable. The risk-free rate currently is 2%, the beta for the technology sector is 1.3, and the market return rate is 10%. Plugging these values into the CAPM equation, the cost of equity is: \[Re = 2\% + 1.3 * (10\% - 2\%) = 2\% + 1.3 * 8\% = 12.4\%\] The company then compares this cost of equity with the expected return rate of the new project. If the expected return is greater than 12.4%, the company will consider the project; otherwise, it will not proceed.

It's important to note how the beta value, a measure of systematic risk, greatly influences the cost of equity and hence the final decision in this scenario. An investment may have a high expected return, but high systematic risk (beta) can lead to a high cost of equity, making the investment less attractive. This case study thus underpins the importance of considering risk (alongside potential returns) in investment decisions, which lies at the heart of the CAPM.

This hypothetical scenario underscores how the Capital Asset Pricing Model can aid corporations in strategic financial decisions, taking us beyond theoretical understanding to a more practical, tangible illustration of the CAPM in action.

Flashcards in Capital Asset Pricing Model60

Start learningWhat does the Capital Asset Pricing Model (CAPM) help determine in the context of an investment?

CAPM helps determine the expected return of an investment given its systematic risk.

What are some of the core assumptions made by the Capital Asset Pricing Model (CAPM)?

The core assumptions include rational and risk-averse investors, same one period time horizon for investment, no taxes or transaction costs, infinite divisibility of investments, all investors having the same information, and a universal risk-free rate.

Why is it important to understand the assumptions of the CAPM model?

Understanding these assumptions helps accurately interpret the model's predictions about an investment's expected return and guides strategic investment decision-making.

What does the Capital Asset Pricing Model (CAPM) assumption of 'risk-averse and rational investors' relate to?

This assumption implies that investors aim to maximise their wealth and minimise risk, making informed decisions based on available market information.

What does the 'single-period transaction horizon' assumption in CAPM mean?

This assumption suggests that all investors make plans for the same single period, which simplifies the calculations of return on investment.

How does CAPM define 'perfect capital market' under its set of assumptions?

Under CAPM, a perfect capital market is one with no transaction costs, taxes, or restrictions on borrowing.

Already have an account? Log in

Open in AppThe first learning app that truly has everything you need to ace your exams in one place

Sign up to highlight and take notes. It’s 100% free.

Save explanations to your personalised space and access them anytime, anywhere!

Sign up with Email Sign up with AppleBy signing up, you agree to the Terms and Conditions and the Privacy Policy of StudySmarter.

Already have an account? Log in