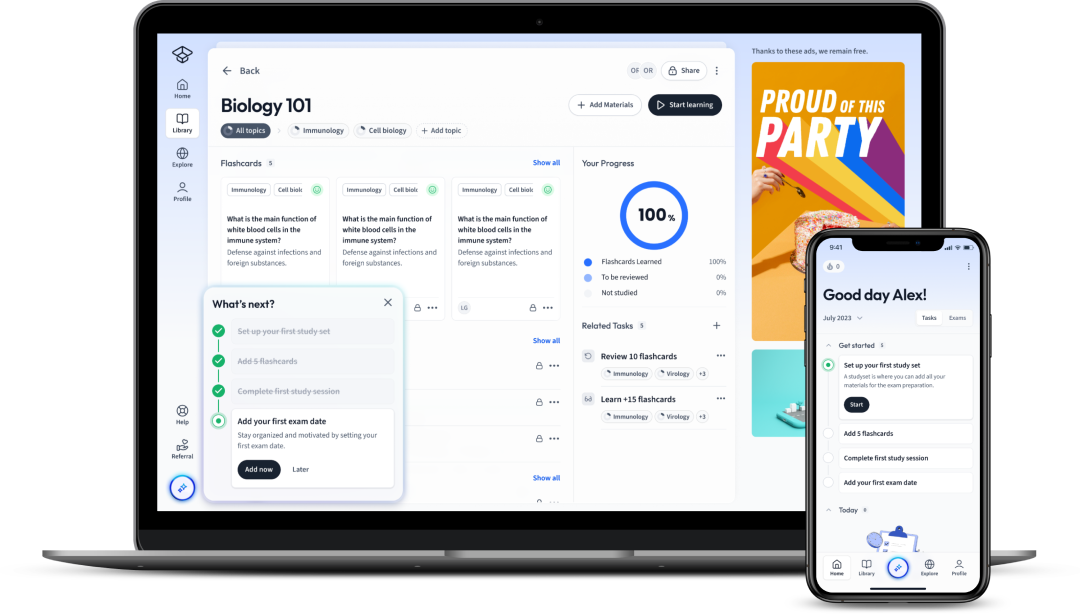

StudySmarter - The all-in-one study app.

4.8 • +11k Ratings

More than 3 Million Downloads

Free

Americas

Europe

Delve into the intricacies of Corporate Debt Yield with this in-depth analysis of its meaning, implications, and management techniques. This comprehensive guide gives you a detailed understanding of the business world, illuminating vital aspects of high yield corporate debt and the effects of bond yield on corporate debt. Explore the complexities of negative yield corporate debt and discover how mastering debt management techniques can provide financial leverage. Gain an extensive understanding and learn practical skills for better business financial management.

Explore our app and discover over 50 million learning materials for free.

Lerne mit deinen Freunden und bleibe auf dem richtigen Kurs mit deinen persönlichen Lernstatistiken

Jetzt kostenlos anmeldenDelve into the intricacies of Corporate Debt Yield with this in-depth analysis of its meaning, implications, and management techniques. This comprehensive guide gives you a detailed understanding of the business world, illuminating vital aspects of high yield corporate debt and the effects of bond yield on corporate debt. Explore the complexities of negative yield corporate debt and discover how mastering debt management techniques can provide financial leverage. Gain an extensive understanding and learn practical skills for better business financial management.

Corporate Debt Yield is a ratio demonstrating how much a company earns in relation to its outstanding debt. It is calculated by dividing the company's operating income by its total debts. Mathematically, it can be represented as \( \frac{Operating \, Income}{Outstanding \, Debt} \).

| Yield Ratio | Financial Stability |

| High | Strong |

| Medium | Moderate |

| Low | Weak |

By applying the Corporate Debt Yield formula \( \frac{Operating \, Income}{Outstanding \, Debt} \), we would get \( \frac{1,000,000}{4,000,000} \) which equals 0.25. This suggests that for every pound of debt, TechGen Corp generates 25 pence in income. This can be interpreted as a moderate yield.

But what happens if operating income changes? With the same amount of debt (£4,000,000), suppose the operating income increases to £2,000,000. The Corporate Debt Yield will then increase to \( \frac{2,000,000}{4,000,000}\) which equals 0.5. This shows that for every pound of debt, TechGen Corp now generates 50 pence, indicating a higher yield and a stronger financial stability. Conversely, a decrease in operating income would imply a lower yield, signalling greater risk to the company's creditors and investors.

Current Bond Yield is calculated as \( \frac{Annual \, Interest \, Payment}{Current \, Bond \, Price} \).

The current bond yield can be calculated as \( \frac{70}{900} \), which equals 0.078 or 7.8%. This shows that the current bond yield becomes more attractive to new investors when bond prices fall and vice versa.

Consider SafeHaven Corp that issues a bond with a face value of £1,000 at a negative yield of -0.5%. Instead of receiving the full £1,000, an investor who buys the bond will receive £950 after the bond matures. Here, SafeHaven Corp effectively gets paid £50 to borrow £1,000.

Flashcards in Corporate Debt Yield24

Start learningWhat is the Corporate Debt Yield?

Corporate Debt Yield is a financial ratio showing how much a company earns in relation to its outstanding debt. It is calculated by dividing the company's operating income by its total debts.

How can the Corporate Debt Yield be interpreted?

A higher Corporate Debt Yield indicates strong financial stability and suggests that the company can manage its debt well. A lower yield implies concerns about the company's ability to repay its debts, signaling potential risk for investors.

How can the Corporate Debt Yield be useful?

The Corporate Debt Yield is useful for analyzing a company's financial strength, understanding its risk level, and evaluating its potential for investment.

How is the Corporate Debt Yield calculated in the example of TechGen Corp with an operating income of £1,000,000 and total debts of £4,000,000?

In the case of TechGen Corp, by applying the formula \( \frac{Operating \, Income}{Outstanding \, Debt} \), its Corporate Debt Yield would be \( \frac{1,000,000}{4,000,000} \) which equals 0.25.

What does high yield corporate debt signify in the world of investment?

High yield corporate debt is debt of a corporation that offers a high return or interest due to increased risk associated with the company's ability to meet its financial obligations.

What are the key benefits of high yield corporate debt for investors?

The benefits include high potential returns if the company's rating improves or the high-yield debt market strengthens, and portfolio diversification beyond traditional equity and lower-yield bonds.

Already have an account? Log in

Open in AppThe first learning app that truly has everything you need to ace your exams in one place

Sign up to highlight and take notes. It’s 100% free.

Save explanations to your personalised space and access them anytime, anywhere!

Sign up with Email Sign up with AppleBy signing up, you agree to the Terms and Conditions and the Privacy Policy of StudySmarter.

Already have an account? Log in