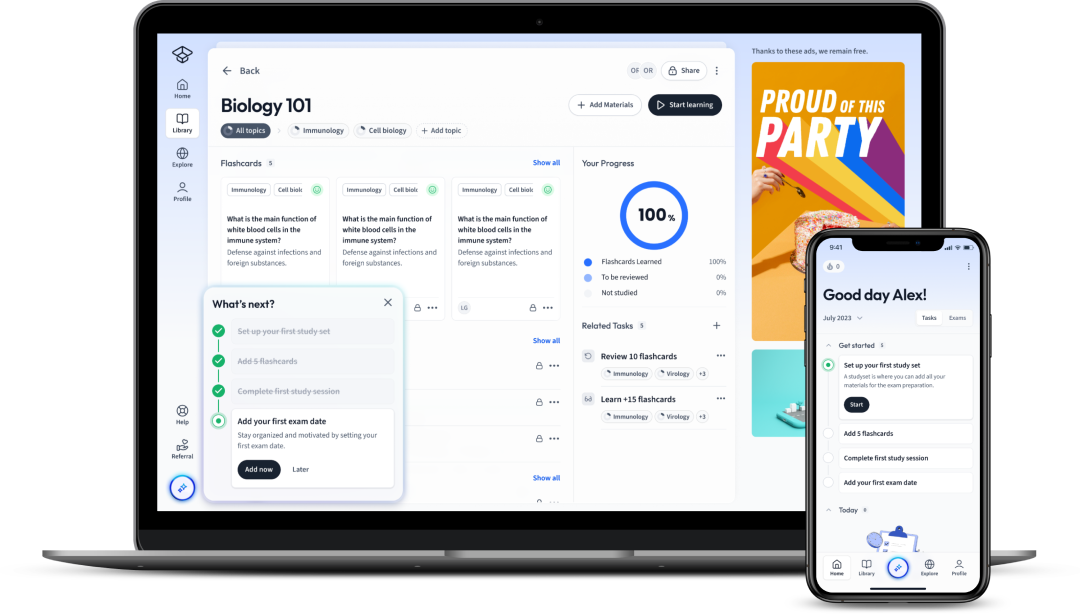

StudySmarter - The all-in-one study app.

4.8 • +11k Ratings

More than 3 Million Downloads

Free

Americas

Europe

Navigating your way through the complex waters of international business? Then understanding currency risk - a crucial aspect of Business Studies - is vital. In this comprehensive exploration, you'll gain insights into the definition, examples, and practical applications of currency risk. Uncover strategies for managing and mitigating this risk, extend your knowledge about hedging techniques and delve deep into the process of analysis and measurement, understand its impact on critical business decisions. Equip yourself with the invaluable tools and techniques to identify, manage, and mitigate currency risk effectively.

Explore our app and discover over 50 million learning materials for free.

Lerne mit deinen Freunden und bleibe auf dem richtigen Kurs mit deinen persönlichen Lernstatistiken

Jetzt kostenlos anmeldenNavigating your way through the complex waters of international business? Then understanding currency risk - a crucial aspect of Business Studies - is vital. In this comprehensive exploration, you'll gain insights into the definition, examples, and practical applications of currency risk. Uncover strategies for managing and mitigating this risk, extend your knowledge about hedging techniques and delve deep into the process of analysis and measurement, understand its impact on critical business decisions. Equip yourself with the invaluable tools and techniques to identify, manage, and mitigate currency risk effectively.

When doing international business or investing in foreign markets, you may encounter the term 'Currency Risk'. But what exactly is this risk and how does it impact businesses financially?

Also known as exchange rate risk, currency risk is a type of financial risk that arises from potential changes in the exchange rate between two currencies. In essence, businesses are exposed to currency risk whenever they have receivables or payable in a foreign currency.

Naturally, businesses hate uncertainty. Variability in exchange rates poses a significant amount of unpredictability and potential financial losses. If the exchange rate fluctuates unfavorably, it can erode your profits simultaneously. For instance, if you have receivables in a foreign currency and that currency weakens against your home currency, the value of your receivables in your home currency drops.

Moreover, currency risk is recognized in the financial statements of businesses. It is considered as a part of their foreign exchange gains or losses. Therefore, adequate management of currency risk is very crucial for financial stability and profitability.

In the context of Business Studies, currency risk is viewed as a type of financial risk. It concerns the potential for financial losses resulting from changes in the foreign exchange rates. It's also involved in prospective investments, where the return value could decrease due to changes in currency exchange rates.

Consider a UK-based company selling products to a US-based client. The product is sold in dollars (USD). The UK company will take the risk of exchange rate fluctuations between USD and British Pound (GBP) from the time of sale until the payment collection.

Managing currency risk is a part of the financial strategy for many firms with international operations. It is not just limited to multinational corporations but also affects small businesses and individuals who might be working or investing overseas.

For instance, suppose an Indian student plans to study in the United Kingdom and takes a student loan in Indian rupees (INR). The extortionate costs of violations and tuition fees are all set in British pounds (GBP). Any fluctuation in the currency exchange rate between INR and GBP would affect the amount of money needed for repaying the loan.

This scenario illustrates how even individuals can face currency risk. Therefore, understanding and managing currency risk effectively is vital for financial stability, whether it's for businesses, investors, or individuals operating across borders.

Managing and mitigating currency risk is central to ensuring the financial stability of businesses with international exposure. Currency risk is not confined to any specific business size or category; instead, it cuts across various business landscapes. Whether you are an entrepreneur exporting goods to overseas markets or a massive multinational firm with a global supply chain, currency risk – if not managed effectively – can have severe implications on your bottom line.

Effective management of currency risk requires a harmonious blend of strategic planning, setting procedural boundaries, and finally, choosing the best financial instruments. Here's a non-exhaustive list of strategies that you could use:

Handling foreign currency risk does not mean completely eradicating the risk. Instead, it's about understanding the risk, measuring it, and then choosing the best possible action to mitigate it strategically. This responsibility often falls onto the shoulders of financial managers, who use various techniques and financial instruments to manage currency risk.

One common technique is by using currency futures or options. A currency futures contract allows you to buy or sell a specific currency at a specified price on a specified future date. This guarantees that even if the currency fluctuates significantly, you remain shielded from the severe consequences of such fluctuations.

While the complete elimination of currency risk might not be possible, businesses can certainly take steps to mitigate it. Broadly, it should involve the following steps:

| Assessment | Identify and assess potential currency risks. Estimate the potential impact of currency fluctuations on your financials. |

| Strategy | Develop a comprehensive risk management strategy detailing how you'll address the identified risks. |

| Implementation | Carry out the risk management strategies— this may involve natural hedging, using financial derivatives or adjusting pricing strategies. |

| Monitoring | Regularly review the effectiveness of your strategies and adjust as needed. Stay updated with market developments and economic trends. |

At the heart of the foreign currency risk management lies a proficient understanding of financial markets and instruments. The most common techniques used are:

However, remember that these strategies should not be used in isolation. They need to be part of a comprehensive risk management plan, considering factors like corporate finance policies, market conditions, and the company's operational realities.

Building on your understanding of currency risk, let's delve into how businesses use hedging to navigate foreign exchange volatility.

Hedging currency risk is a financial strategy that is employed to protect against potential losses caused by fluctuating foreign exchange rates. When you enter a hedge, you aim to offset a possible adverse price movement in an asset or liability with a corresponding gain or loss in a derivative.

A derivative is a financial contract that derives its value from an underlying asset such as currencies. Derivatives commonly used for hedging include futures, options and swaps.

Bear in mind that hedging is not about profit-making. Its primary purpose is to reduce exposure to currency risk by buffering against exchange rate fluctuations. The critical elements in a typical hedging process include:

Crucially, remember that to hedge, or not to hedge, often depends on the company's risk appetite, industry, business model, and currency exposure.

To bring the theory of hedging to life, consider a multi-national corporation that imports raw materials from abroad in USD and sells the finished goods in the domestic market in GBP. The company faces currency risk as it has to pay its suppliers in USD which can fluctuate significantly against GBP. To hedge this risk, the company may use various derivatives:

If it wants to hedge the risk out completely, the company might enter into a forward contract. The forward contract would allow the company to buy a certain amount of USD at a specified exchange rate, effectively fixing the cost of its raw materials in GBP.

Alternatively, if the company thinks the USD might weaken, but it still wants to protect against the risk of it strengthening, it could use a foreign exchange option. A currency option would give the company the right, but not the obligation, to buy USD at a specific exchange rate. If the USD weakens, the company can simply let the option expire and buy USD at the lower market rate. But if the USD strengthens, they can still purchase USD at the previously agreed (lower) rate, using the option.

The choice between forwards and options or a combination of the two will often depend on how the company weighs up the certainty of a forward contract against the flexibility and additional potential upside of an option.

The important takeaway is that hedging is a practical tool which can help firms navigate the unpredictable world of currency exchange, adding a layer of financial stability and predictability to their operations.

Analysing and measuring currency risk is a crucial aspect of international business finance. When doing business across borders, currency values play a central role, and fluctuations in those values introduce an element of uncertainty. Currency risk, also known as foreign exchange risk or FX risk, is the potential loss that may arise from changes in exchange rates. By analysing and measuring currency risk, businesses can understand their exposure and take appropriate steps to mitigate it.

Many tools and techniques exist for analysing currency risk, each with its strengths and applications. These are broadly categorised into qualitative and quantitative tools.

Sensitivity Analysis provides an estimate of how changes in exchange rates will affect the company’s future cash flows and ultimately, profitability. This analysis might involve revising cash flow forecasts using different exchange rate scenarios.

The Value at Risk (VaR) method, on the other hand, measures the worst expected loss over a given time period under normal market conditions at a certain confidence level. The VaR approach can be calculated using either the variance-covariance method, historical simulation, or Monte Carlo simulation.

To get the most comprehensive picture of currency risk, businesses often use a mix of these tools, allowing them to balance the insights of data-driven analysis with expert opinion and scenario planning.

The process of measuring currency risk can involve several steps, and the specific methodology can vary depending on the needs and resources of the business. At a high level, however, the process might include:

Although measuring currency risk may seem daunting, it is an essential factor in managing the uncertainty of international business. Having a clear understanding of how currency fluctuations could impact the business can guide your risk mitigation strategies.

When it comes to the impact and consequences of currency risk, direct and indirect implications can be observed. Direct implications are usually immediately visible on your profit and loss account, while indirect implications may be less immediate, such as an effect on your competitiveness.

| Type of Impact | Explanation |

| Direct Impact | This can be seen the most directly in the company's transaction exposure. For example, if an overseas supplier invoices you in their local currency and the exchange rate moves between the invoice issue date and the payment date, this could have a significant impact on the cost of your purchases in your home currency terms. |

| Indirect Impact | These are usually seen over a while. A substantial movement in exchange rates will likely have a knock-on effect on the competitive positioning of a company in the market, particularly if the company is an exporter or importer. |

Additionally, currency risk can also influence investment decisions and capital structure of companies and can lead to changes in the perceived riskiness of companies, which can affect their market valuation.

Currency risk can have a significant influence on both tactical and strategic business decisions. From tactical decisions like whether to pre-pay an overseas supplier, through to strategic decisions such as which countries to enter or exit, the potential financial impact of unpredictable currency movements always needs to be considered.

For example, an exporter deciding their international pricing strategy will need to take into account future currency movements. If they expect their home currency to strengthen, they might decide to set prices in their home currency to shield their profits from the adverse impact of the currency movement. Alternatively, if they expect their home currency to weaken, they might choose to price in the buyer’s currency to take advantage of the positive effect on profits when the overseas revenues are converted back to the home currency.

On a strategic level, if a company is considering foreign direct investment, currency risk will play into the decision-making process. The project's potential returns might be considerably affected by future exchange rate movements, making a seemingly profitable investment unviable.

Therefore, understanding currency risk and its potential impact is crucial for sound business decisions in today's global economy.

Flashcards in Currency Risk42

Start learningWhat is Currency Risk in the context of international business?

Currency risk, also known as exchange rate risk, is a type of financial risk arising from potential changes in the exchange rate between two currencies. It is a concern when businesses have receivables or payable in a foreign currency, as fluctuations can impact profits.

How does currency risk impact businesses?

Currency risk can lead to financial losses for businesses. If the exchange rate fluctuates unfavorably, it can decrease the value of receivables in a company's home currency, affecting profits. This risk is recognized in financial statements as a part of foreign exchange gains or losses.

How can currency risk be viewed in practical scenarios?

Currency risk applies not just to businesses, but also individuals operating across borders. For instance, if an Indian student takes a loan in rupees to study in the UK, any fluctuation in the exchange rate between the rupee and the pound will affect the amount needed to repay the loan.

What is currency risk and who does it affect?

Currency risk is the financial risk resulting from fluctuations in foreign exchange rates. It affects all businesses with international exposure, regardless of their size or sector, from small entrepreneurs to large multinational corporations.

What are some strategies for managing currency risk?

Some strategies for managing currency risk include natural hedging, where businesses match foreign currency assets with foreign liabilities; financial hedging using futures, options, and swaps; strategic pricing to offset the effects of currency fluctuations; and shopping around banks for the best exchange rates.

What are the steps to mitigate currency risk in corporate finance?

Steps to mitigate currency risk involve an assessment stage to identify and estimate potential risks, planning and implementing a comprehensive risk management strategy, and continuously monitoring and adjusting the strategy based on market developments and economic trends.

Already have an account? Log in

Open in AppThe first learning app that truly has everything you need to ace your exams in one place

Sign up to highlight and take notes. It’s 100% free.

Save explanations to your personalised space and access them anytime, anywhere!

Sign up with Email Sign up with AppleBy signing up, you agree to the Terms and Conditions and the Privacy Policy of StudySmarter.

Already have an account? Log in