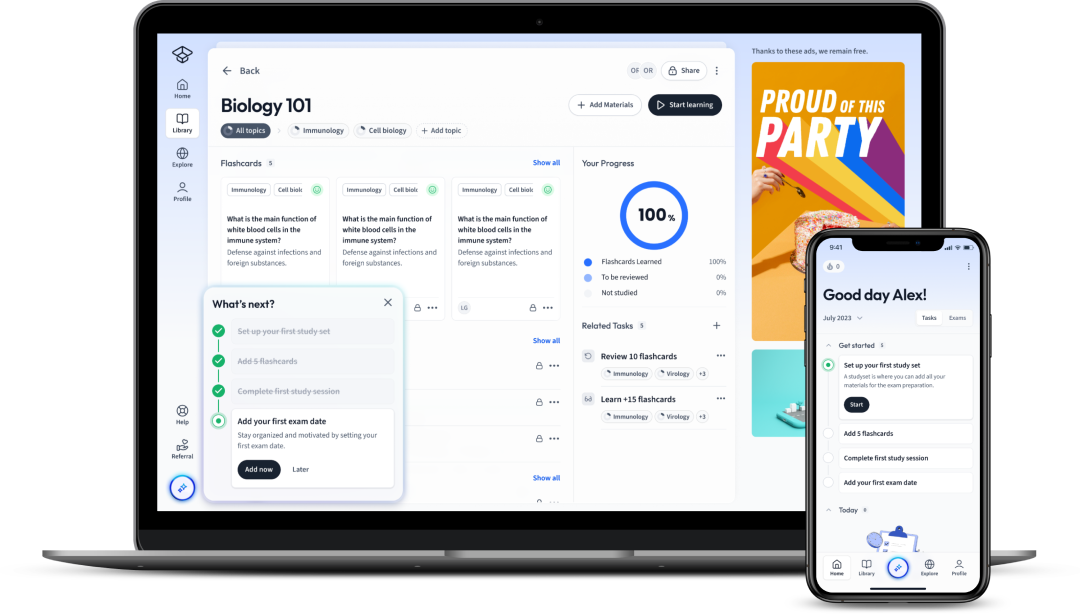

StudySmarter - The all-in-one study app.

4.8 • +11k Ratings

More than 3 Million Downloads

Free

Americas

Europe

Dive into the comprehensive exploration of Default Risk in this Business Studies resource. You will gain an in-depth understanding of what default risk represents, the factors causing it, and the pivotal concept of default risk premium. Further, you’ll encounter practical examples of default risk in corporate finance and its implication on business operations. Lastly, the guide provides proven techniques for effectively managing and reducing default risk – vital knowledge for any business professional.

Explore our app and discover over 50 million learning materials for free.

Lerne mit deinen Freunden und bleibe auf dem richtigen Kurs mit deinen persönlichen Lernstatistiken

Jetzt kostenlos anmeldenDive into the comprehensive exploration of Default Risk in this Business Studies resource. You will gain an in-depth understanding of what default risk represents, the factors causing it, and the pivotal concept of default risk premium. Further, you’ll encounter practical examples of default risk in corporate finance and its implication on business operations. Lastly, the guide provides proven techniques for effectively managing and reducing default risk – vital knowledge for any business professional.

When delving into the topic of Business Studies, you may come across various financial risks associated with lending and borrowing, one of which is Default Risk. This concept entails the uncertainty of a borrower defaulting on any type of debt by failing to make necessary payments. As part of the risk management process, it's fundamentally important to understand the implications of this risk before partaking in any form of lending or investing. So, let's get a better grasp on what Default Risk is all about.

Default Risk, often referred to as credit risk, is the potential risk that a debtor will not repay a debt according to the agreement. It essentially reflects the likelihood of the debtor defaulting on the loan due to the inability to make required payments.

To quantify this, financial institutions attribute a default risk rating to each debt issued. The higher the risk, the higher the interest rate requested in order to compensate for the risk taken.

It's worth noting that even sovereign nations, albeit seldom, can default on their external debt. This situation is known as Sovereign Default and can drastically impact the global economy.

The following factors typically contribute to an increased Default Risk:

Default Risk Premium is the additional interest charged by lenders to compensate for the risk of a default. It is effectively the difference between the yield on a corporate bond and a risk-free government bond (like U.S. Treasuries).

Lenders consider the risk factor and consequently adjust the cost of borrowing accordingly. The formula to calculate the Default Risk Premium is \( DRP = R_{corporate} - R_{risk-free} \), where \( R_{corporate} \) is the yield on the corporate bond and \( R_{risk-free} \) is the yield on a risk-free government bond.

Suppose a corporate bond offers a return rate of 7% while a risk-free government bond yields a 3% return. The Default Risk Premium would be \( DRP = 7\% - 3\% = 4\% \). Therefore, the additional premium charged by the lender to compensate for the higher risk is 4%.

In conclusion, understanding Default Risk and the Default Risk Premium is vital for anyone involved in lending, borrowing, or investing. By learning about these risks and premiums, you can avoid economic pitfalls and make informed financial decisions.

Examples are a great avenue to shed more light on theoretical concepts. With regards to Default Risk, certain real-world instances can vividly outline the intricacies of this term and its practical implications. By showcasing these, you'll grasp a deeper understanding of how Default Risk works and its profound impact on Corporate Finance and Business Operations.

In Corporate Finance, Default Risk plays a critical role in the lending and borrowing landscape. For instance, let's consider a corporation looking to fund an expansion project through bonds. The interest rate specified on these corporate bonds directly reflects the company's perceived Default Risk.

Let's illustrate this situation with a hypothetical example:

Company X and Company Y both issue bonds worth $1 million. However, Company X has a robust financial standing and a proven track record of timely debt repayments. In contrast, Company Y has experienced some financial turbulence and has even had times where they've struggled to meet debt obligations. As a consequence, potential bond investors perceive a higher Default Risk for Company Y. To compensate, Company Y needs to offer a higher interest rate on their bonds to attract investors. If Company X offers a 5% interest rate, Company Y might need to offer a 7% rate or higher to persuade investors.

This example displays how Default Risk can affect the cost of borrowing for companies.

Default Risk paints a broader picture of risk exposure in Business Operations. For any business that offers credit terms to its customers or takes on debt to finance operations, Default Risk is always present.

For instance, if a company has a prominent ratio of its income coming from credit sales, it runs the risk of customers failing to pay their bills on time or at all. Such defaults can disrupt cash flow, hamper the company's ability to pay its bills, fulfil inventory requirements, or even maintain ordinary operations.

Consider this scenario:

Online Retailer Z sells products to customers, offering them the option to "Buy Now, Pay Later." This offer is enticing for customers, but it also means Retailer Z bears the Default Risk. If too many customers default on their payments, Retailer Z might be unable to pay suppliers or even cover overhead costs, leading to profound operational and financial impacts.

Moreover, businesses taking large loans or issuing bonds to finance expansion or operations are also subject to Default Risk. If the company's income decreases or interest rates increase, the company may be unable to meet its debt obligations, leading to default.

Through these examples, it's clear that Default Risk can significantly influence a company's operations and financial health. Therefore, businesses must develop strong strategies to manage this risk.

In the world of business and finance, minimizing Default Risk is crucial. This fraught risk factor entails a debtor failing to repay the loan amount or not fulfilling the debt terms. Therefore, it's highly important to have a set of effective techniques to manage Default Risk. Below, you'll find a range of strategies that businesses and financial institutions can adopt to diminish this substantive risk.

In order to manage Default Risk, financial institutions usually implement certain strategies. These techniques aim to preemptively identify, assess and alleviate potential risk factors, ensuring the risk of default is kept at a minimum.

Commonly adopted techniques include:

To implement these techniques effectively, financial institutions often use risk management software and AI technologies for predictive analysis. Tools like these help to quickly and accurately process large amounts of data, contributing to more informed decision making.

Default Risk doesn't solely concern lenders but is equally important for businesses, especially those offering credit to customers or relying on debt to finance operations. Knowing how to properly manage this risk can make all the difference when it comes to achieving sustainable success.

Among the strategies businesses can employ to reduce Default Risk, the following are considered the most effective:

It’s important to understand that the exact strategies used can vary greatly depending on the nature and size of the business, the sectors and markets in which it operates, and the specific risk factors it faces. Thus, organisations should tailor their Default Risk management efforts to suit their unique circumstances and requirements.

Default Risk management is an ongoing effort, not a one-and-done task. Regular monitoring and assessment of debtors’ financial health and the business environment are key to clearly recognise signs of potential default. By proactively managing Default Risk, businesses can enhance their financial stability, increase their resilience, and set themselves up for long-term success.

Flashcards in Default Risk39

Start learningWhat is Default Risk?

Default Risk, also known as credit risk, is the potential risk that a debtor will not repay a debt as per the agreement due to the inability to make required payments.

What factors contribute to an increased Default Risk?

The factors typically contributing to an increased Default Risk include financial instability, economic downturn, and increases in interest rates.

What is the Default Risk Premium?

Default Risk Premium is the additional interest charged by lenders to compensate for the potential risk of a debtor defaulting. It is the difference between the yield on a corporate bond and a risk-free government bond's yield.

How to calculate the Default Risk Premium?

The Default Risk Premium can be calculated by subtracting the yield on a risk-free government bond from the yield on a corporate bond.

What is an example of how Default Risk plays a key role in Corporate Finance?

In a situation where a company with a risky financial history is issuing bonds, it would have to offer higher interest rates to attract investors due to the high perceived Default Risk.

How does Default Risk affect a company's operations?

If a company offers credit terms to customers or relies on debt to finance operations, Default Risk can disrupt cash flow and compromise its ability to meet its obligations, potentially affecting its operations.

Already have an account? Log in

Open in AppThe first learning app that truly has everything you need to ace your exams in one place

Sign up to highlight and take notes. It’s 100% free.

Save explanations to your personalised space and access them anytime, anywhere!

Sign up with Email Sign up with AppleBy signing up, you agree to the Terms and Conditions and the Privacy Policy of StudySmarter.

Already have an account? Log in